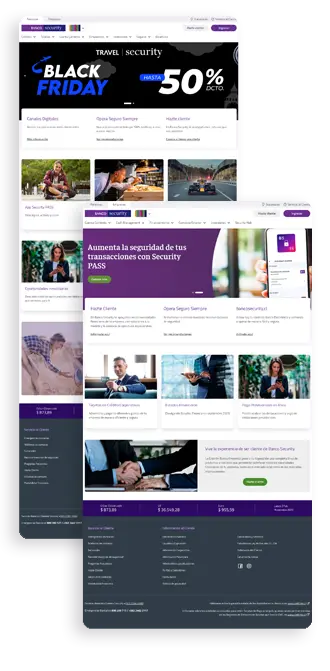

Security Bank

Challenges

Security Bank, a company that is part of the Grupo Security financial holding company. It experienced challenges inherited from the financial group to which it belongs, among which the following stand out:

Limited User Experience: The interface was not intuitive, which created difficulties for customers when interacting with the bank's online services.

Innovation and Technological Agility: They needed agility to implement new functionalities and services to remain competitive in a constantly evolving market.

Disorganized benefits page: The information was not easily accessible or organized, the lack of a search engine and proper categorization limited the user experience, leaving room for significant improvements.

Solution

To address these challenges, Grupo Security partnered with our team of digital transformation experts who proposed a comprehensive solution:

Drupal

The migration of Security Bank's public websites (individuals and companies) to Drupal began. This allowed a more efficient and unified management of content. API's were developed for integration with their information systems.

Component System

As a starting point, we optimized existing Grupo Security components and created new elements that expanded the library, providing greater customization options for sites.

Support and Maintenance

After the implementation of the websites, the team continued to provide ongoing support and maintenance to ensure operability and user satisfaction.

Results

The implementation of these solutions achieved a significant change Security Bank, improving the experience of its users.experience of its users.

Significant improvement in customer satisfaction: The focus on user experience resulted in higher customer satisfaction, with a significant reduction in complaints related to the digital platform.

Creative Control: The ability to easily edit and customize content allowed Security Bank to have greater creative control over their websites, enabling them to quickly adapt to changing market demands.

Portals Optimization: Thanks to continuous support and regular updates, the portals underwent constant optimization, improving efficiency and usability.

Site Availability: The Acquia Cloud platform demonstrated exceptional reliability, maintaining site availability above 99%, ensuring a seamless experience for users.

New Benefits Page: This page was redesigned by adding a search engine, categories and a section of outstanding benefits. This page is of great importance, since it is one of the Bank's strategies to attract new customers.

Improvements in the Simulators: Improvements were made to the mortgage and consumer credit simulators, making the necessary interactions with the bank's systems.